How Pvm Accounting can Save You Time, Stress, and Money.

How Pvm Accounting can Save You Time, Stress, and Money.

Blog Article

Examine This Report on Pvm Accounting

Table of ContentsSome Known Factual Statements About Pvm Accounting Our Pvm Accounting IdeasSome Of Pvm AccountingFacts About Pvm Accounting UncoveredGetting The Pvm Accounting To WorkUnknown Facts About Pvm Accounting

Make sure that the bookkeeping procedure conforms with the legislation. Apply required construction audit requirements and procedures to the recording and coverage of construction task.Understand and preserve typical cost codes in the audit system. Communicate with different financing firms (i.e. Title Business, Escrow Business) pertaining to the pay application procedure and needs required for settlement. Handle lien waiver dispensation and collection - https://disqus.com/by/leonelcenteno/about/. Monitor and solve financial institution concerns consisting of cost abnormalities and inspect differences. Aid with applying and maintaining inner economic controls and treatments.

The above declarations are planned to explain the general nature and degree of job being carried out by people appointed to this classification. They are not to be interpreted as an exhaustive checklist of obligations, duties, and skills required. Employees might be required to perform obligations beyond their typical responsibilities periodically, as needed.

What Does Pvm Accounting Mean?

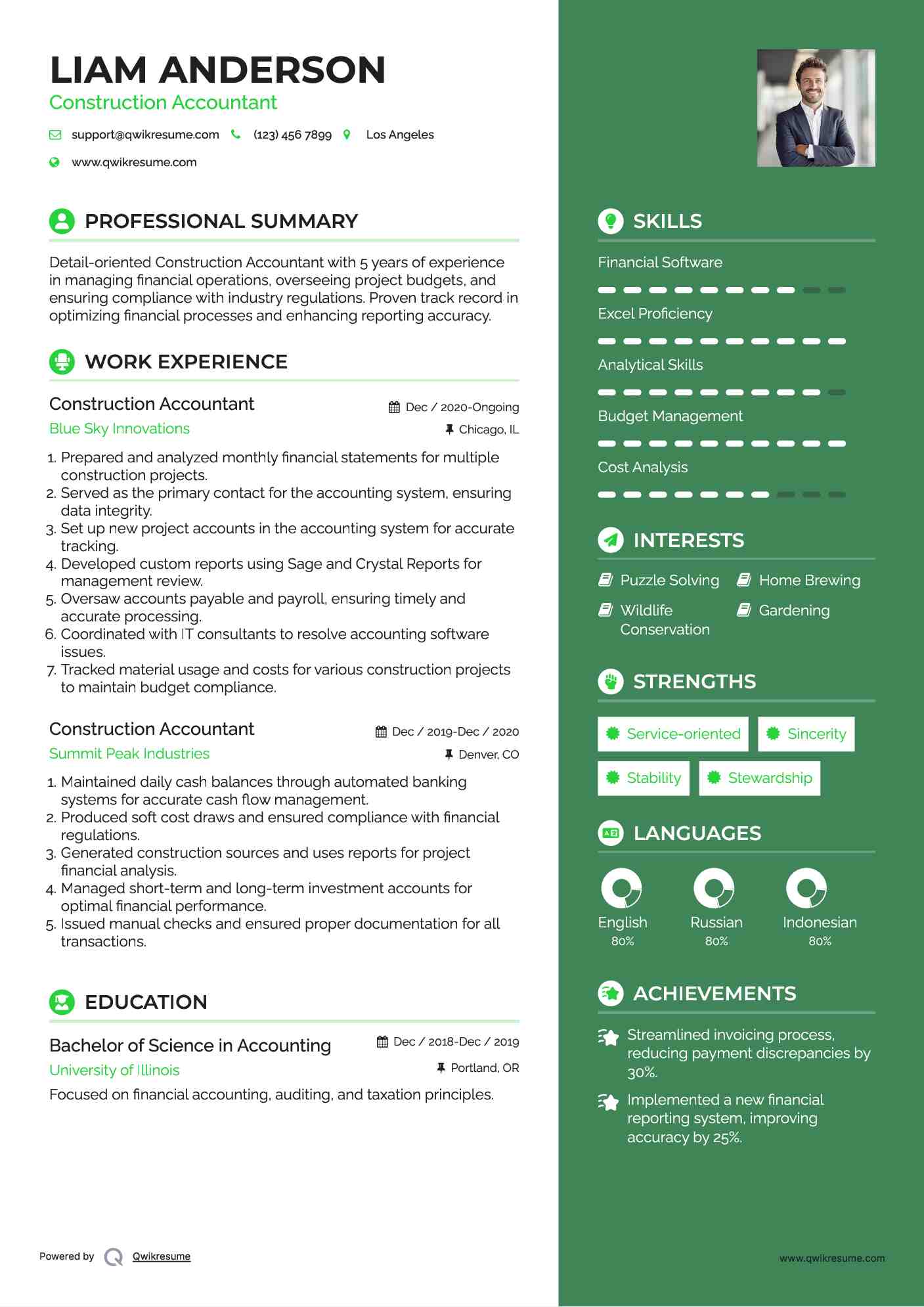

You will certainly assist sustain the Accel team to make certain shipment of effective in a timely manner, on budget, jobs. Accel is seeking a Building and construction Accountant for the Chicago Workplace. The Building and construction Accounting professional carries out a selection of bookkeeping, insurance policy compliance, and job management. Works both individually and within specific divisions to preserve economic documents and make certain that all records are kept existing.

Principal responsibilities include, but are not restricted to, taking care of all accounting features of the company in a prompt and precise way and supplying records and timetables to the company's CPA Firm in the prep work of all monetary statements. Makes certain that all accounting procedures and functions are managed properly. In charge of all monetary documents, pay-roll, financial and day-to-day procedure of the audit feature.

Works with Task Supervisors to prepare and post all regular monthly invoices. Creates monthly Work Cost to Date records and working with PMs to integrate with Project Supervisors' budgets for each task.

Pvm Accounting Can Be Fun For Anyone

Efficiency in Sage 300 Construction and Actual Estate (previously Sage Timberline Office) and Procore building monitoring software a plus. https://pvmaccount1ng.bandcamp.com/album/pvm-accounting. Must likewise excel in other computer system software systems for the preparation of reports, spread sheets and various other accounting analysis that might be called for by management. construction bookkeeping. Have to have strong organizational skills and capability to focus on

They are the economic custodians that make certain that construction projects continue to be on spending plan, adhere to tax policies, and preserve monetary transparency. Building accounting professionals are not simply number crunchers; they are critical companions in the building and construction procedure. Their key duty is to take care of the economic elements of construction projects, ensuring that resources are allocated efficiently and financial risks are minimized.

Some Known Factual Statements About Pvm Accounting

They work closely with task supervisors to create and monitor spending plans, track costs, and forecast economic requirements. By maintaining a limited hold on project funds, accountants help protect against overspending and monetary setbacks. Budgeting is a keystone of successful construction jobs, and construction accounting professionals contribute in this regard. They produce comprehensive spending plans that include all task costs, from materials and labor to licenses and insurance.

Browsing the complicated internet of tax guidelines in the construction market can be tough. Construction accountants are fluent in these guidelines and make certain that the project adheres to all tax demands. This includes handling pay-roll tax obligations, sales taxes, and any type of various other tax obligation obligations particular to building and construction. To excel in the here role of a building accounting professional, people require a strong educational foundation in bookkeeping and financing.

Additionally, accreditations such as Cpa (CPA) or Licensed Building Industry Financial Professional (CCIFP) are highly regarded in the industry. Functioning as an accounting professional in the building and construction market includes a distinct set of challenges. Construction tasks usually entail limited due dates, changing regulations, and unanticipated expenditures. Accountants should adjust promptly to these difficulties to keep the project's economic health and wellness intact.

Not known Facts About Pvm Accounting

Expert accreditations like CPA or CCIFP are additionally very suggested to demonstrate proficiency in building and construction audit. Ans: Building accountants develop and keep an eye on budgets, identifying cost-saving chances and guaranteeing that the project remains within budget. They likewise track expenses and projection monetary needs to protect against overspending. Ans: Yes, building accountants take care of tax conformity for building tasks.

Introduction to Building Bookkeeping By Brittney Abell and Daniel Gray Last Updated Mar 22, 2024 Building companies need to make difficult options amongst several economic alternatives, like bidding on one task over another, choosing financing for products or equipment, or setting a job's earnings margin. Building and construction is a notoriously unstable industry with a high failing price, slow-moving time to payment, and inconsistent cash flow.

Common manufacturerConstruction business Process-based. Manufacturing involves duplicated procedures with quickly recognizable costs. Project-based. Manufacturing requires different procedures, materials, and devices with varying expenses. Fixed place. Production or production occurs in a single (or numerous) controlled areas. Decentralized. Each project occurs in a brand-new area with varying website conditions and distinct obstacles.

Not known Details About Pvm Accounting

Frequent usage of various specialty contractors and distributors influences effectiveness and cash circulation. Settlement shows up in full or with normal repayments for the full agreement amount. Some portion of settlement may be withheld till job conclusion also when the professional's job is completed.

Regular manufacturing and short-term agreements cause manageable cash money flow cycles. Irregular. Retainage, sluggish payments, and high ahead of time expenses lead to long, uneven cash circulation cycles - construction accounting. While standard producers have the benefit of controlled settings and optimized manufacturing processes, building and construction companies have to continuously adjust to each brand-new task. Even rather repeatable projects need alterations because of website conditions and various other factors.

Report this page